Highest Paying Dividend Stocks 2025 In India Images References : - Best Paying Dividend Stocks 2025 Essie Jacynth, Detailed guide on creating screens. Stocks Paying Highest Dividends 2025 Cyndy Katine, The investors who want to earn good returns from their investments but are only aware about the traditional options.

Best Paying Dividend Stocks 2025 Essie Jacynth, Detailed guide on creating screens.

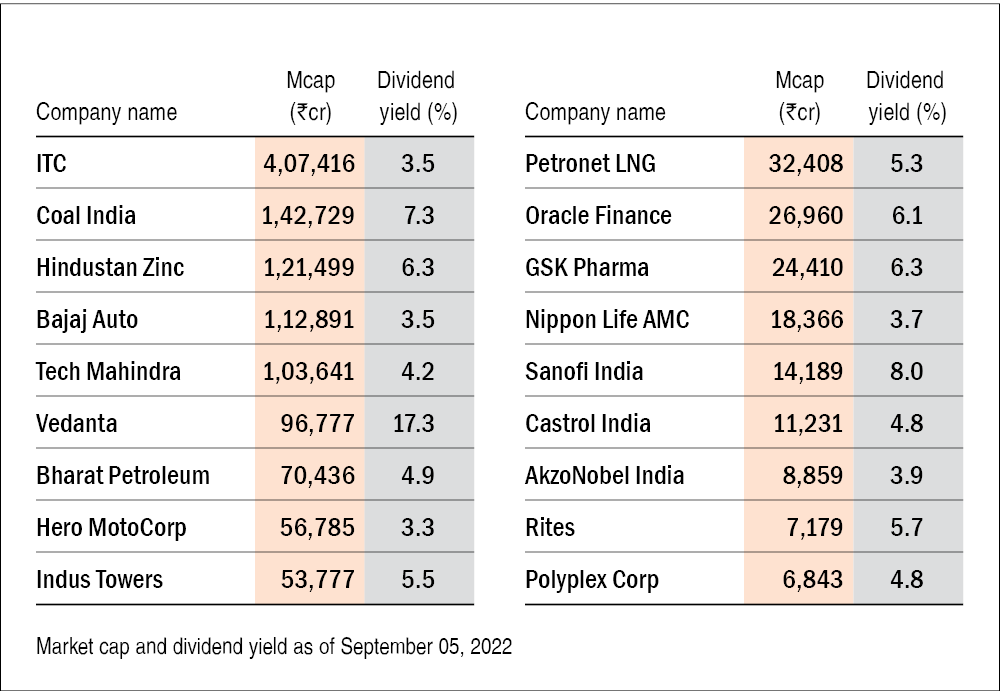

High Dividend Yield Stocks India 2025 Jenda Lorette, Top 20 high dividend stocks in india (updated 2025) the burgeoning indian economy is the driving force behind the stock market’s remarkable upward.

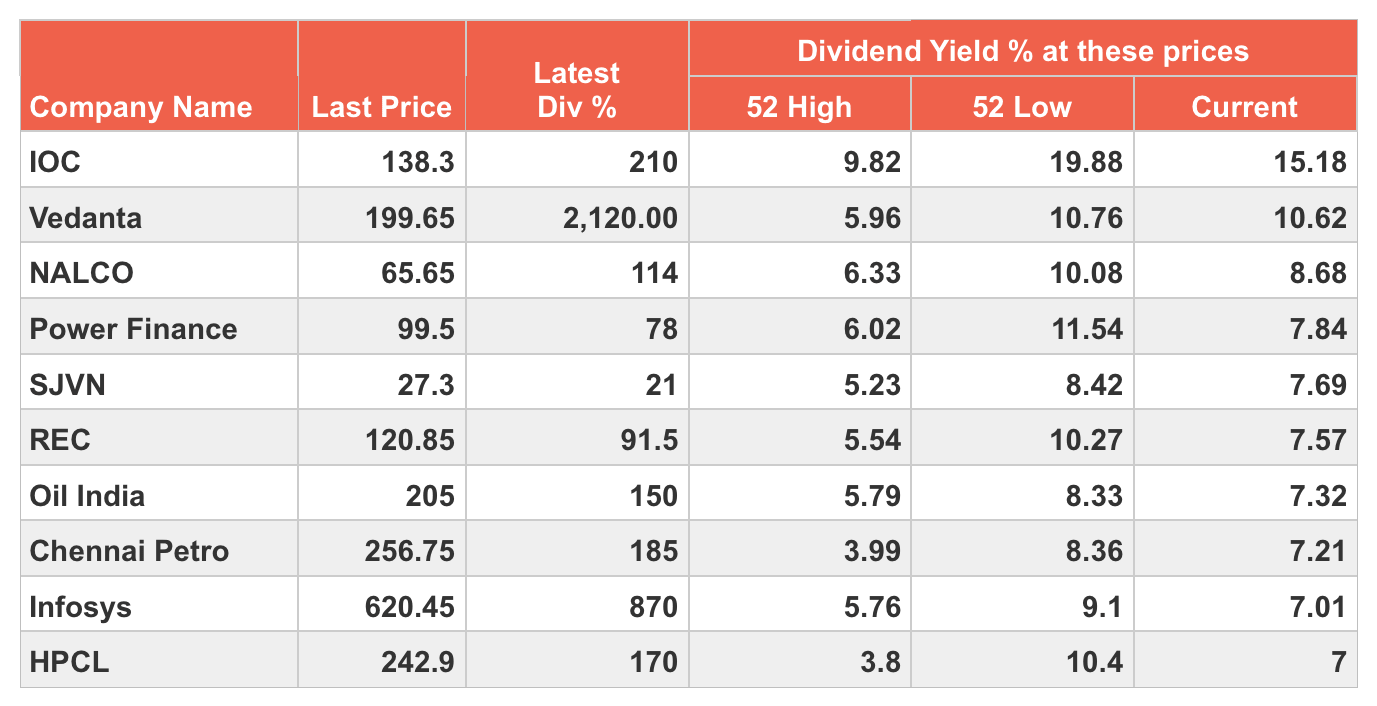

Highest Paying Dividend Stocks 2025 In India Renie Idaline, Bharat petroleum corporation limited (bpcl) offers a dividend yield of 6.85%, ranking in the top 25% in the indian market.

Highest Dividend Paying Stocks in India for 2025 List of 10 High, Discover the best and highest dividend stocks to buy in india for 2025.

Explore the top 10 highest dividend paying stocks in india for 2025, stock overviews, their benefits and how to invest in these best monthly dividend yield shares. Discover which companies are paying out dividends to its shareholders.

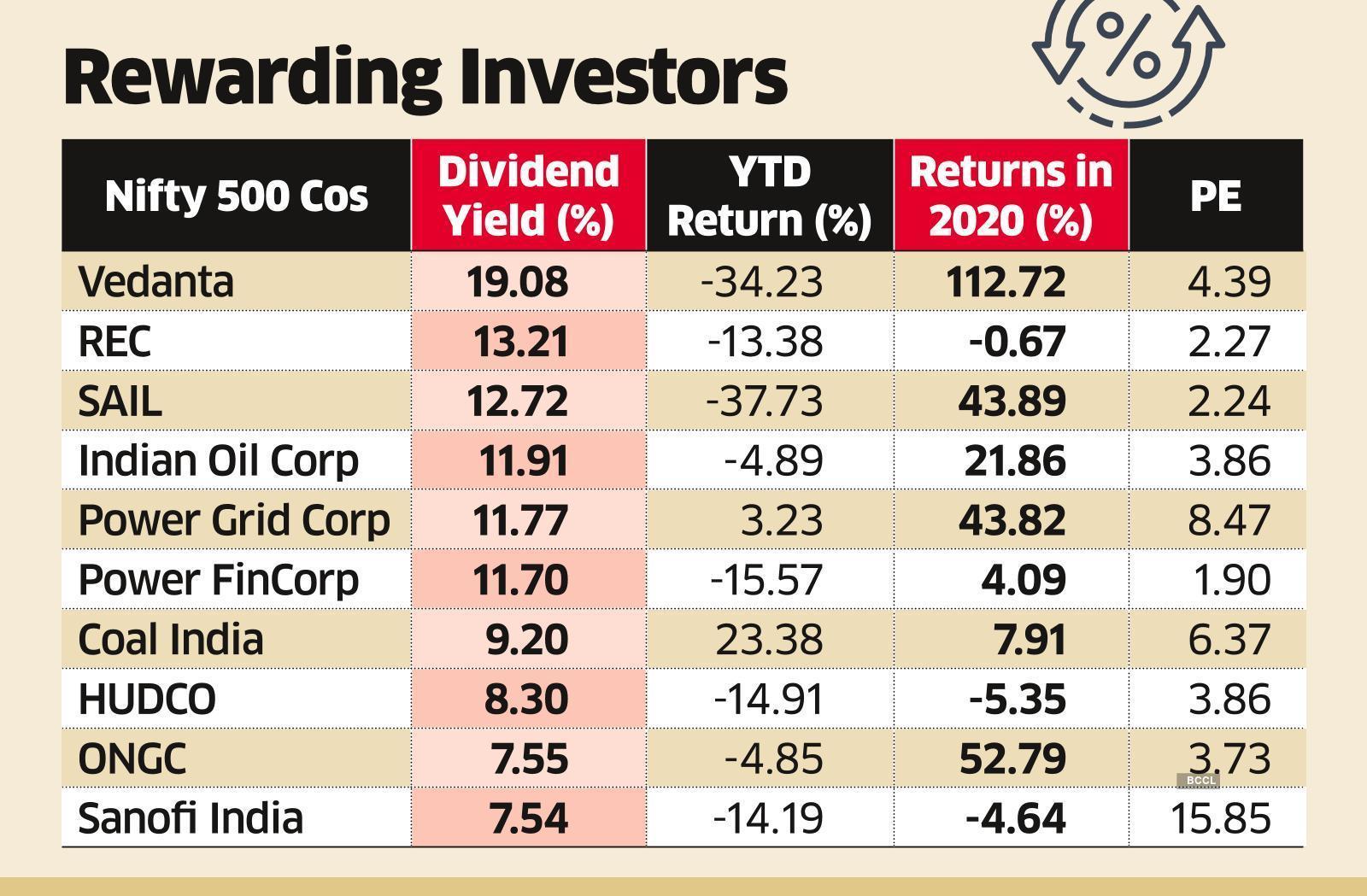

Highest Paying Dividend Stocks 2025 Tana Zorine, The highest dividend paying stocks in india are aster dm healthcare, xchanging solutions, il&fs investment managers, vedanta and coal india which are.

High Dividend Paying Stocks 2025 Inez Reggie, Explore the top 5 highest dividend paying stocks in india 2025 with a complete analysis of whether to go for dividend yield or capital growth stocks

Best Stocks With Dividends 2025 Kinna Diannne, Detailed guide on creating screens.

Highest Paying Dividend Stocks 2025 In India. Explore top 10 dividend yield stocks to buy for long term & short term investment in 2025 on choice finx. Bharat petroleum corporation limited (bpcl) offers a dividend yield of 6.85%, ranking in the top 25% in the indian market.

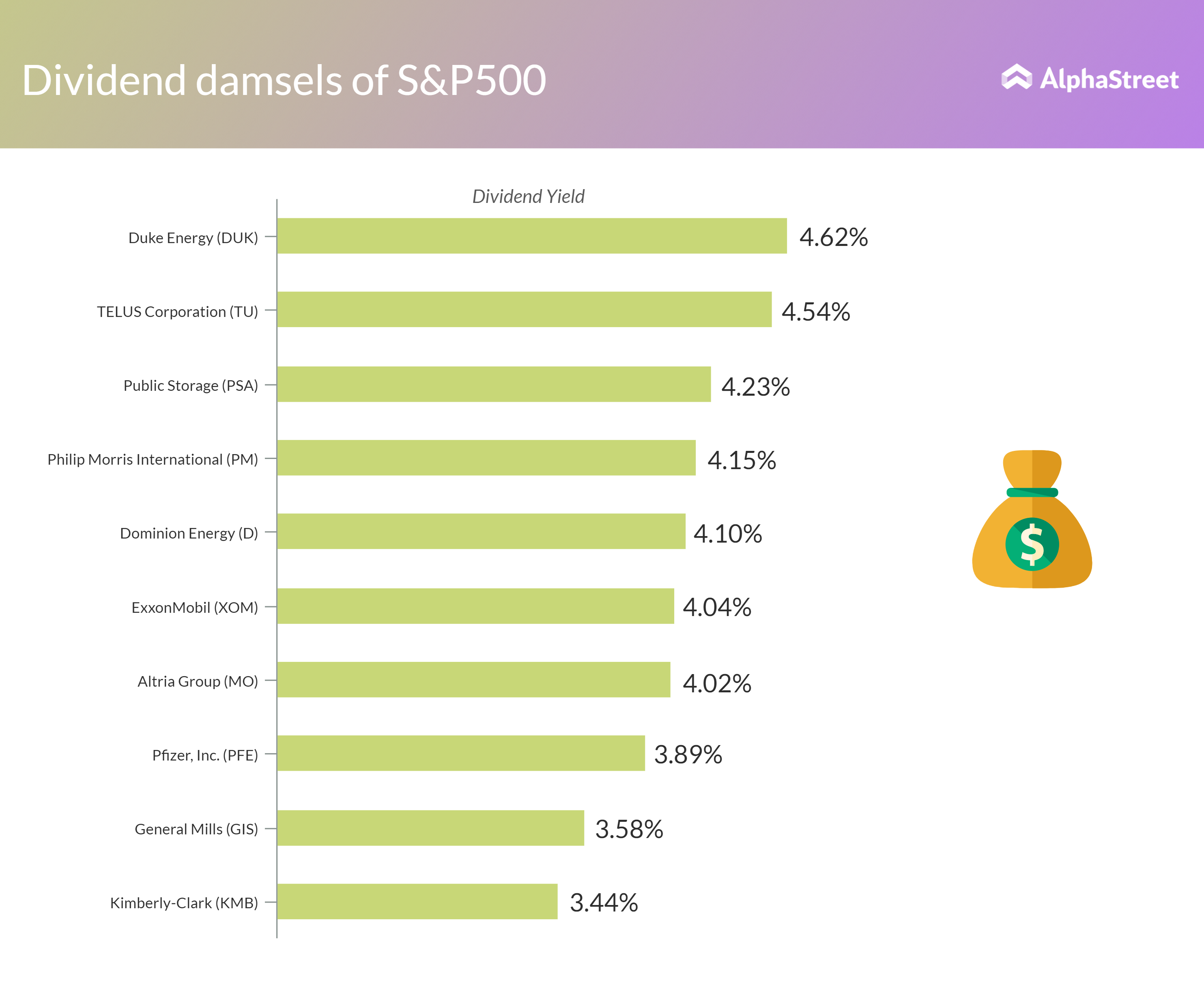

Highest Paying Dividend Stocks 2025 Uk Salli Consuela, Best dividend stocks in india in 2025.

Top Dividend Stocks For 2025 Angil Karlotta, Market capitalization > 500 and price to earning < 15 and return on capital employed > 22%.